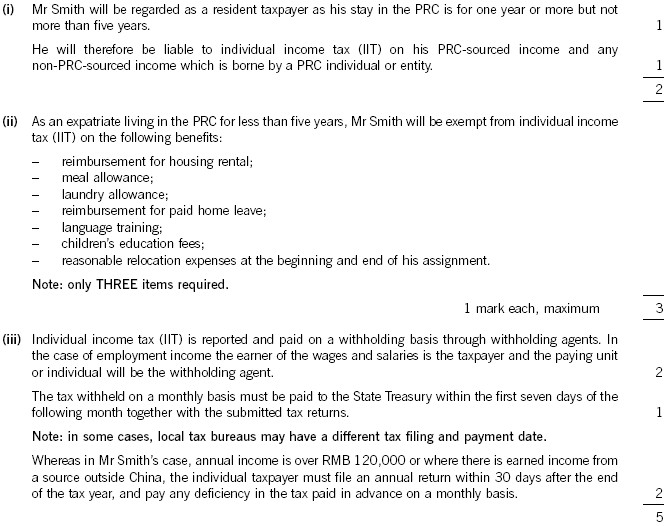

(b) Mr Smith, who is a UK national, is employed by a UK construction company to work in Shanghai on a project that will last for a period of 18 consecutive months.Required:(i) State, giving reasons, whether Mr Smith will be a resident taxpayer or a non-resident taxpayer in the PRC and the scope of his individual income tax (IIT) assessment; (2 marks)(ii) List any THREE fringe benefits that can be provided to Mr Smith that will not be subject to individual income tax (IIT) in China; (3 marks)(iii) Briefly explain the requirements for the reporting and payment of the individual income tax (IIT) due for Mr Smith if he is paid RMB 30,000 per month. (5 marks)

参考答案: