问题

选择题

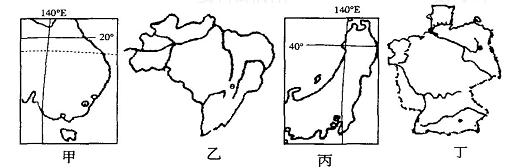

下列四国为世界主要国家,读图回答37—38题:

小题1:有关四国的地理特征,叙述不正确的是

A.甲国被誉为“骑在羊背上的国家”

B.乙国是世界最大的农产品出口国

C.丙国的北部海域有世界著名的渔场

D.丁国位于欧洲大陆上的“十字路口”小题2:有关四国大城市的叙述,正确的是

A.四国的最大港口皆受到暖流的影响

B.四国的首都职能均属单一

C.四国最大城市都是著名的国际金融中心

D.四国的主要城市都分布在东南沿海

答案

小题1:B

小题2:A