阅读理解。

Have you ever been at a meeting while someone was making a speech and realized suddenly that your

mind was a million miles away? You probably felt sorry and made up your mind to pay attention and always

have been told that daydreaming is a waste of time.

"On the contrary," says L. Giambra, an expert in psychology, "daydreaming is quite necessary. Without

it, the mind couldn't get done all the thinking it has to do during a normal day. You can't possibly do all your

thinking with a conscious (有意识) mind. Instead, your unconscious mind is working out problems all the

time. Daydreaming then may be one way that the unconscious and conscious states of mind have silent

dialogues."

Early experts in psychology paid no attention to the importance of daydreams or even considered them

harmful. At one time daydreaming was thought to be a cause of some mental illnesses. They did not have

a better understanding of daydreams until the late 1980s. Eric Klinger, a professor of psychology, is the

writer of the book Daydreaming. Klinger says, "We know now that daydreaming is one of the main ways

that we organize our lives, learn from our experiences, and plan for our futures. Daydreams really are a

window on the things we fear and the things we long for in life."

Daydreams are usually very simple and direct, quite unlike sleep dreams, which may be hard to understand.

It's easier to gain a deep understanding of your life by paying close attention to your daydreams than by trying

to examine your sleep dreams carefully. Daydreams help you recognize the difficult situations in your life and

find out a possible way of dealing with them.

Daydreams cannot be predicated (预料). They move off in unexpected directions which may be creative

and full of ideas. For many famous artists and scientists, daydreams were and are a main source of creative

energy.

1. The writer of this passage considers daydreams _____. [ ]

A. hard to understand

B. important and helpful

C. harmful and unimportant

D. the same as sleep dreams

2. The writer quoted (引用) L. Giambra and Eric Klinger to _____. [ ]

A. point out the wrong ideas of early experts

B. list two different ideas

C. support his own idea

D. report the latest research on daydreams

3. Which of the following is TRUE?[ ]

A. An unconscious mind can work all the problems out.

B. Daydreaming can give artists and scientists ideas for creation.

C. Professor Eric Klinger has a better idea than L. Giambra.

D. Early experts fully understood what daydreams were.

4. What is the main difference between daydreams and sleep dreams?

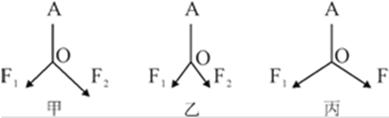

.对于乙同学

.对于乙同学 ,对于丙同学,

,对于丙同学, .可见操作不合适的是乙同学,因为他的两个力的合力超过了弹簧测力计的最大值

.可见操作不合适的是乙同学,因为他的两个力的合力超过了弹簧测力计的最大值