问题

问答题

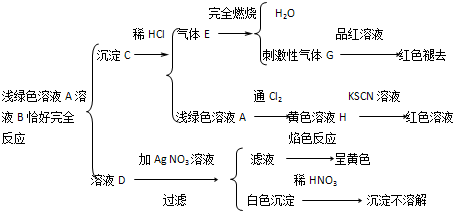

浅绿色溶液A和无色溶液B可进行下列反应,D是一种常见的盐,E是气态氢化物,G是非金属氧化物.

(1)填写下列各物质的化学式:A______,B______,H______;

(2)浅绿色溶液A与NaOH溶液反应先生成白色沉淀,此沉淀迅速变成灰绿色最后变成红褐色,写出此反应过程中的化学方程式

①______;

②______.

(3)写出沉淀C与稀盐酸反应生成浅绿色溶液A和气体E的化学方程式:______.

答案

溶液D加入硝酸银后生成沉淀不溶于稀硝酸,应为AgCl,且滤液焰色反应呈黄色,则D为NaCl,G可使品红褪色,应为SO2,则E为H2S,H可与KSCN反应呈红色,则H为FeCl3,A为FeCl2,则B为Na2S,

(1)由以上分析可知A为FeCl2,B为Na2S,H为FeCl3,故答案为:FeCl2;Na2S;FeCl3;

(2)浅绿色溶液A与NaOH溶液反应先生成白色沉淀,反应为FeCl2+2NaOH=2NaCl+2Fe(OH) 2↓,此沉淀迅速变成灰绿色最后变成红褐色,反应为4Fe(OH) 2+O2+2H2O=4Fe(OH) 3 ,故答案为:FeCl2+2NaOH=2NaCl+2Fe(OH) 2↓;4Fe(OH) 2+O2+2H2O=4Fe(OH) 3 ;

(3)沉淀C为FeS,可与盐酸反应,反应的化学方程式为FeS+2HCl=FeCl2+H2S↑,故答案为:FeS+2HCl=FeCl2+H2S↑.