十届全国人大常委会第十八次会议初次审议了个人所得税法修正案草案。草案将个人工资、薪金所得纳税额的每月减除标准即个税起征点由原来的800元上调到1 600元,并且规定各地应统一执行该标准,不允许擅自浮动。

(1)据专家测算,国家调高个税起征点后,当年就将减少税收收入200多亿元。为此,有人认为:“个人利益与集体(国家)利益是相互冲突的。”你对此是如何认识的?

(2)从本地、本单位的利益出发,擅自浮动个税起征点既是违背集体主义的表现,又是一种违法的行为。那么为什么说从本地、本单位的利益出发是违背集体主义的行为?

(1)题中观点是不正确的。在我国,个人利益与集体(国家)利益放在本质上是一致的。一方面,个人利益与集体(国家)利益互为前提而存在;另一方面,个人利益与集体(国家)利益互相促进而共同发展。国家调高个税起征点,减轻工薪阶层的个税负担,正是国家更好地完善自身、更好地满足个人正当利益的具体表现。

(2)集体主义倡导把国家、集体利益放在首位,把国家、集体和个人利益结合起来。从本地、本单位的利益出发,割裂了国家、集体和个人三者的利益关系,是小团体主义或本位主义的表现,其实质是极端狭隘的个人主义。因此,坚持集体主义,就要顾全大局、反对小团体主义或本位主义。

第(1)问为辨析题,首先应对论点作出正确的评价,然后说明评价的理论依据——个人利益与集体利益在本质上的一致性,同时应与材料内容有机结合在一起,避免“两张皮”现象。第(2)问虽是新材料,但问题较基础,需要结合材料内容准确、简要的记忆课本中的基本内容,并要指出正确的做法。

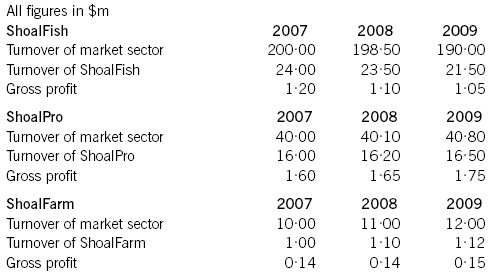

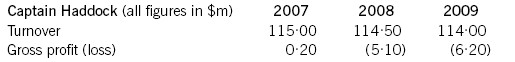

Figure 1: Financial data on individual companies 2007–2009Captain HaddockThe Captain Haddock chain of restaurants was founded in 1992 by John Dory. It currently operates one hundred and thirty restaurants in the country serving high quality fi sh meals. Much of Captain Haddock’s success has been built on the quality of its food and service. Captain Haddock has a tradition of recruiting staff directly from schools and universities and providing them with excellent training in the Captain Haddock academy. The academy ensures that employees are aware of the ‘Captain Haddock way’ and is dedicated to the continuation of the quality service and practices developed by John Dory when he launched the fi rst restaurant. All management posts are fi lled by recruiting from within the company, and all members of the Captain Haddock board originally joined the company as trainees. In 1999 the Prime Minister of the country identifi ed Captain Haddock academy as an example of high quality in-service training. In 2000, Captain Haddock became one of the thirty best regarded brands in the country.In the past few years, the fi nancial performance of Captain Haddock has declined signifi cantly (see Figure 2) and the company has had diffi culty in meeting its bank covenants. This decline is partly due to economic recession in the country and partly due to a disastrous diversifi cation into commercial real estate and currency dealing. The chairman and managing director of the company both resigned nine months ago as a result of concern over the breaking of banking covenants and shareholder criticism of the diversifi cation policy. Some of the real estate bought during this period is still owned by the company. In the last nine months the company has been run by an interim management team, whilst looking for prospective buyers. At restaurant level, employee performance still remains relatively good and the public still highly rate the brand. However, at a recent meeting one of the employee representatives called for a management that can ‘effectively lead employees who are increasingly demoralised by the decline of the company’.Shoal plc is currently fi nalising their takeover of the Captain Haddock business. The company is being bought for a notional $1 on the understanding that $15 million is invested into the company to meet short-term cash fl ow problems and to improve liquidity. Shoal plc’s assessment is that there is nothing fundamentally wrong with the company and that the current fi nancial situation is caused by the failed diversifi cation policy and the cost of fi nancing this. The gross profi t margin in the sector averages 10%.Captain Haddock currently buys its fi sh and fi sh products from wholesalers. It is the intention of Shoal plc to look at sourcing most of the dishes and ingredients from its own companies; specifi cally ShoalFish, ShoalPro and ShoalFarm. Once the takeover is complete (and this should be within the next month), Shoal plc intends to implement signifi cant strategic change at Captain Haddock so that it can return to profi tability as soon as possible. Shoal plc has implemented strategic change at a number of its acquisitions. The company explicitly recognises that there is no ‘one right way’ to manage change. It believes that the success of any planned change programme depends on an understanding of the context in which the change is taking place.

Figure 1: Financial data on individual companies 2007–2009Captain HaddockThe Captain Haddock chain of restaurants was founded in 1992 by John Dory. It currently operates one hundred and thirty restaurants in the country serving high quality fi sh meals. Much of Captain Haddock’s success has been built on the quality of its food and service. Captain Haddock has a tradition of recruiting staff directly from schools and universities and providing them with excellent training in the Captain Haddock academy. The academy ensures that employees are aware of the ‘Captain Haddock way’ and is dedicated to the continuation of the quality service and practices developed by John Dory when he launched the fi rst restaurant. All management posts are fi lled by recruiting from within the company, and all members of the Captain Haddock board originally joined the company as trainees. In 1999 the Prime Minister of the country identifi ed Captain Haddock academy as an example of high quality in-service training. In 2000, Captain Haddock became one of the thirty best regarded brands in the country.In the past few years, the fi nancial performance of Captain Haddock has declined signifi cantly (see Figure 2) and the company has had diffi culty in meeting its bank covenants. This decline is partly due to economic recession in the country and partly due to a disastrous diversifi cation into commercial real estate and currency dealing. The chairman and managing director of the company both resigned nine months ago as a result of concern over the breaking of banking covenants and shareholder criticism of the diversifi cation policy. Some of the real estate bought during this period is still owned by the company. In the last nine months the company has been run by an interim management team, whilst looking for prospective buyers. At restaurant level, employee performance still remains relatively good and the public still highly rate the brand. However, at a recent meeting one of the employee representatives called for a management that can ‘effectively lead employees who are increasingly demoralised by the decline of the company’.Shoal plc is currently fi nalising their takeover of the Captain Haddock business. The company is being bought for a notional $1 on the understanding that $15 million is invested into the company to meet short-term cash fl ow problems and to improve liquidity. Shoal plc’s assessment is that there is nothing fundamentally wrong with the company and that the current fi nancial situation is caused by the failed diversifi cation policy and the cost of fi nancing this. The gross profi t margin in the sector averages 10%.Captain Haddock currently buys its fi sh and fi sh products from wholesalers. It is the intention of Shoal plc to look at sourcing most of the dishes and ingredients from its own companies; specifi cally ShoalFish, ShoalPro and ShoalFarm. Once the takeover is complete (and this should be within the next month), Shoal plc intends to implement signifi cant strategic change at Captain Haddock so that it can return to profi tability as soon as possible. Shoal plc has implemented strategic change at a number of its acquisitions. The company explicitly recognises that there is no ‘one right way’ to manage change. It believes that the success of any planned change programme depends on an understanding of the context in which the change is taking place. Figure 2: Financial information for Captain Haddock 2007–2009Required:

Figure 2: Financial information for Captain Haddock 2007–2009Required: