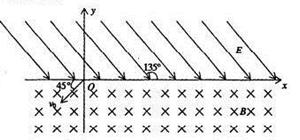

如图所示,x轴的上方存在方向与x轴正方向成1350角的匀强电场,电场强度为E=1×103V/m,x轴的下方存在垂直纸面向里的匀强磁场,磁感应强度B=0.5T。有一个质量为m=1×10-11kg,电荷量为q=1×10-7C的带正电粒子,从坐标原点O以速度v=2×103 m/s沿与x轴负方向成45°角方向进入磁场,设x轴上下方的电场和磁场区域足够大,不计粒子重力。求:

(1)粒子从O点出发到第一次经过x轴前,在磁场中运动轨迹的半径。

(2)粒子从O点出发到第一次经过x轴所经历的时间。

(3)粒子从O点出发到第四次经过x轴的坐标。

(1)0.4m.(2)1.66×10-3s.(3)2.26m.

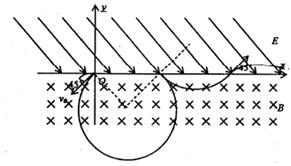

题目分析:(1)粒子运动轨迹如图所示;

粒子在磁场中做匀速圆周运动,由牛顿第二定律得:qvB= ,

,

代入数据解得:R=0.4m;

(2)粒子在匀强磁场中做圆周运动的周期:T= ≈1.26×10-3s,

≈1.26×10-3s,

根据圆的对称性,粒子前两次在磁场中偏转所对应的圆心角分别为270°、90°,

粒子前两次在磁场中运动的总时间t1=T,

粒子第一次在电场中的运动时间:t2= =4×10-4s,

=4×10-4s,

则粒子从O点出发后到第三次经过x轴的时间:

t=t1+t2=1.66×10-3s;

(3)粒子第一次经过x轴时的横轴坐标为x1= R=0.4

R=0.4 m,

m,

粒子第二次进入电场时的速度方向垂直电场,粒子做类平抛运动,

由几何知识可知,沿电场线方向的位移s1和垂直与电场线方向的位移s2大小相等,

即:s1= •

• t22,代入数据解得:s1=s2=0.8m,

t22,代入数据解得:s1=s2=0.8m,

由几何关系可得,粒子第四次通过x轴时的坐标:

x2=2x1+ s2=1.6

s2=1.6 m≈2.26m。

m≈2.26m。