问题

实验题

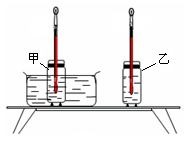

(6分)为了比较水和空气对牛奶的冷却效果,某小组的同学进行了如下的探究实验:将一盒牛奶分别装入两个相同的瓶中,甲瓶放在水中,乙瓶放在空气中,其它条件均相同,如图11所示。实验时,他们每隔一定时间记录一次插在甲、乙两瓶牛奶中的温度计示数如下表所示:

| 时间/min | 0 | 2 | 4 | 6 | 8 | 10 | 12 | 14 | 16 | 18 |

| 甲/℃ | 70 | 60 | 53 | 47 | 42 | 39 | 37 | 35 | 34 | 33 |

| 乙/℃ | 70 | 65 | 61 | 58 | 55 | 52 | 50 | 48 | 47 | 46 |

(1)甲、乙两瓶中的牛奶的多少应该 ___(选填“相等”或“不相等”);

(2)本次实验中,小王发现__ 的冷却效果更好;

(3)通过分析,小王又发现,甲瓶中牛奶冷却快慢前后不一致,是越来越___;

答案

(1)相等(2)甲(3)慢

题目分析:此题中注意运用控制变量法研究问题。将一盒牛奶分别装入两个相同的瓶中,甲瓶放在水中,乙瓶放在空气中,其它条件均相同,是指牛奶的初温、质量等都是相同的。在此题中是通过在相同的冷却时间内比较牛奶的末温来比较对牛奶的冷却效果。(1)甲、乙两瓶中的牛奶的多少应该相等;(2)本次实验中,小王发现甲的末温低所以甲的冷却效果更好;(3)通过分析,小王又发现,甲瓶中牛奶冷却快慢前后不一致,是越来越慢。