问题

选择题

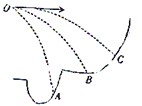

在同一平台上的O点抛出的3个物体,做平抛运动的轨迹均在纸面内,如右图所示,则3个物体做平抛运动的初速度VA、VB、VC的关系分别是 ( )

A.VA>VB>VC,tA>tB>tC

B.VA=VB=VC,tA=tB=tC

C.VA<VB<VC,tA>tB>tC

D.VA<VB<VC,tA<tB<tC

答案

答案:C

考点:

专题:平抛运动专题.

分析:平抛运动在水平方向上做匀速直线运动,在竖直方向上做自由落体运动,落地的时间由高度决定,初速度和时间共同决定水平位移.

解答:解:三个物体落地的高度hA>hB>hc,根据h= gt2,知,tA>tB>tc.

gt2,知,tA>tB>tc.

xA<xB<xc,根据x=vt知,A的水平位移最短,时间最长,则速度最小;c的水平位移最长,时间最短,则速度最大,所以有vA<vB<vc.故C正确,A、B、D错误.

故选C.

点评:解决本题的关键知道平抛运动的时间由高度决定,初速度和时间共同决定水平位移.